avtoelektrik18.online

News

Skills That Make Money

10 Profitable Skills to Learn Online to Make Money from Home · 1. Start a Blog · 2. Get into Real Estate Without Buying or Selling Anything · 3. Freelance Content. Legit work from home jobs, online jobs, part time work from home jobs, money making side hustle ideas, late night jobs to earn extra cash on the side. In a month, you can learn skills like basic graphic design, copywriting, or social media management to start making money, with resources and. There are three main ways that people make money online, no matter what they know or how experienced they are. Most common answer is learn a sellable skill. My question is other then coding, marketing, sales, video editing and Graphic design. Social media marketing, website development, 2. Undoubtedly, one of the most important skills to earn money. Sales is the option on this list that has the greatest need for soft skills, as things like communication skills, collaboration skills, and interpersonal skills. This guide will walk you through the steps you need to take to start making money on Fiverr. We'll cover everything from creating a profile that sells your. Here are five skills you can learn to boost your earning potential and improve your financial situation. 10 Profitable Skills to Learn Online to Make Money from Home · 1. Start a Blog · 2. Get into Real Estate Without Buying or Selling Anything · 3. Freelance Content. Legit work from home jobs, online jobs, part time work from home jobs, money making side hustle ideas, late night jobs to earn extra cash on the side. In a month, you can learn skills like basic graphic design, copywriting, or social media management to start making money, with resources and. There are three main ways that people make money online, no matter what they know or how experienced they are. Most common answer is learn a sellable skill. My question is other then coding, marketing, sales, video editing and Graphic design. Social media marketing, website development, 2. Undoubtedly, one of the most important skills to earn money. Sales is the option on this list that has the greatest need for soft skills, as things like communication skills, collaboration skills, and interpersonal skills. This guide will walk you through the steps you need to take to start making money on Fiverr. We'll cover everything from creating a profile that sells your. Here are five skills you can learn to boost your earning potential and improve your financial situation.

Which skills are commonly associated with high incomes? · Blockchain · Cloud services · Analytical justification · Artificial Intelligence · UX design · Business. There are numerous ways to make money from your talents, such as teaching lessons, offering consulting services, working as a freelancer, and selling your. There are numerous tech skills you can learn to make money online, build a side hustle, or generate extra income. I'm an amateur blogger, video editor, and design enthusiast. Yet, I've managed to earn income in all three areas with minimal skills. Here's how I do it in. So, how do you make bank with copywriting? Once you're confident in your skills, you can offer them as a service. Websites like Upwork and. In a month, you can learn skills like basic graphic design, copywriting, or social media management to start making money, with resources and. It all starts with the earn money online without a big investment model, then develop or fine tune the highest income skill you need to employ. We've compiled 10 skills that are accessible to anyone with a bit of time and a desire to learn. These jobs are in-demand, high-paying and the best part is. This article looked at ways to make money online emphasizing your experience, skills and domain expertise. 10 Most Essential High-Income Skills to Learn in · Online Course Creation · Copywriting · Web Designing · Software Development · Data Analysis · Python. The easiest way and fastest way to make some money on the side as you learn and grow is to focus on sales, client acquisition and marketing. You can start earning money with your tech skills without a computer science degree or 15, 5, or even 1 year of experience. You can make real money from home by leveraging your skills in various remote roles, such as virtual assistance or online tutoring. Identifying your strengths. A marketable skill can give you an edge. With a marketable skill, you can demand more money through a raise or promotion. It's also easier to job hop. Make money online: 10 essential skills to acquire Make money online: 10 essential skills to acquire. Aug 4, Aug 4, By: Deeksha Somani. The Best High-Income Skills You Can Learn Without a Degree · 1. Software Engineering · 2. Audio Production + Video Production · 3. Video or Audio Editing · 4. Skills to Boost Pay ; Arts, Design, Entertainment, Sports, and Media Occupations · User Interface Design, % ; Healthcare Practitioners and Technical Occupations. The most profitable, but also very Skill-demanding Ore to mine is the Runite Ore. Mining Runite requires at least 85 Skill in Mining and a Dragon Pickaxe, for. 16 Ways You Can Use Your Tech Skills to Make $, This Year · Ruby and Ruby on Rails (which you can learn all about in our Ruby Career Blueprint!) · Writing. No matter which money-making route you are on, there are a number of skills that are key to maximising your potential for generating income.

How Much Can I Earn From Donating Plasma

Countries sometimes skirt the WHO resolution and incent donation through gift cards or paid time of. Page recovered from volunteer whole blood donations. Your plasma could be used to treat 50 diseases - and it only takes around an hour to give. You could donate plasma if you are. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. CSL plasma near me pays $45/$60 during the two times you can donate per week. If you do the math you can make $ a month. But they also have. How does the donation process work? Unlike a whole blood donation, where you give whole blood with all three blood components—plasma donations use a special. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. Countries sometimes skirt the WHO resolution and incent donation through gift cards or paid time of. Page recovered from volunteer whole blood donations. Your plasma could be used to treat 50 diseases - and it only takes around an hour to give. You could donate plasma if you are. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. CSL plasma near me pays $45/$60 during the two times you can donate per week. If you do the math you can make $ a month. But they also have. How does the donation process work? Unlike a whole blood donation, where you give whole blood with all three blood components—plasma donations use a special. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change.

How much do you pay for plasma and platelet donations? First-time Donors that schedule a series of donations can earn as much as $ in two months. On average, you can expect between $$ by selling plasma. This process can take anywhere from 1 to 3 hours, and some centers have limits as to how many. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive. How you get paid Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. How much do you pay for plasma and platelet donations? First-time Donors that schedule a series of donations can earn as much as $ in two months. They make 3–5 grand off of ONE donation and they can only give us a punk ass 60 bucks like csl is a networth of 90 plus billion. How much do Plasma Donor jobs pay per hour? The average hourly pay for a Plasma Donor job in the US is $ Hourly salary range is $ to $ Learn how you too can make some extra cash by donating plasma. Read this blog post to discover my experience at BioLife Plasma and how you can get up to. New (first-time) Donors can earn over $* in their first month, and regular, Repeat Donors can earn up to $* a week thereafter! How often can I donate. How It Works. Each time you make a blood, platelet or plasma donation you'll earn points. Whole Blood or Automated Red Cell. What is plasma and why is it important? Plasma serves many important functions in our body. Learn more about plasma and its importance Who should donate. “Dear hero, I don't know who you are, but because you gave plasma, I am no longer disabled." Quote from Crystal, a plasma donation recipient. How can you help. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive. Your plasma could be used to treat 50 diseases - and it only takes around an hour to give. You could donate plasma if you are. You'll typically be paid cash between $50 and $75 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. How much plasma does one donation provide? Each donation yields approximately to milliliters of plasma. Federal regulations allow individuals to. When you make a plasma donation, you donate approximately two to three times the amount of plasma than can be obtained from a whole blood donation. A.

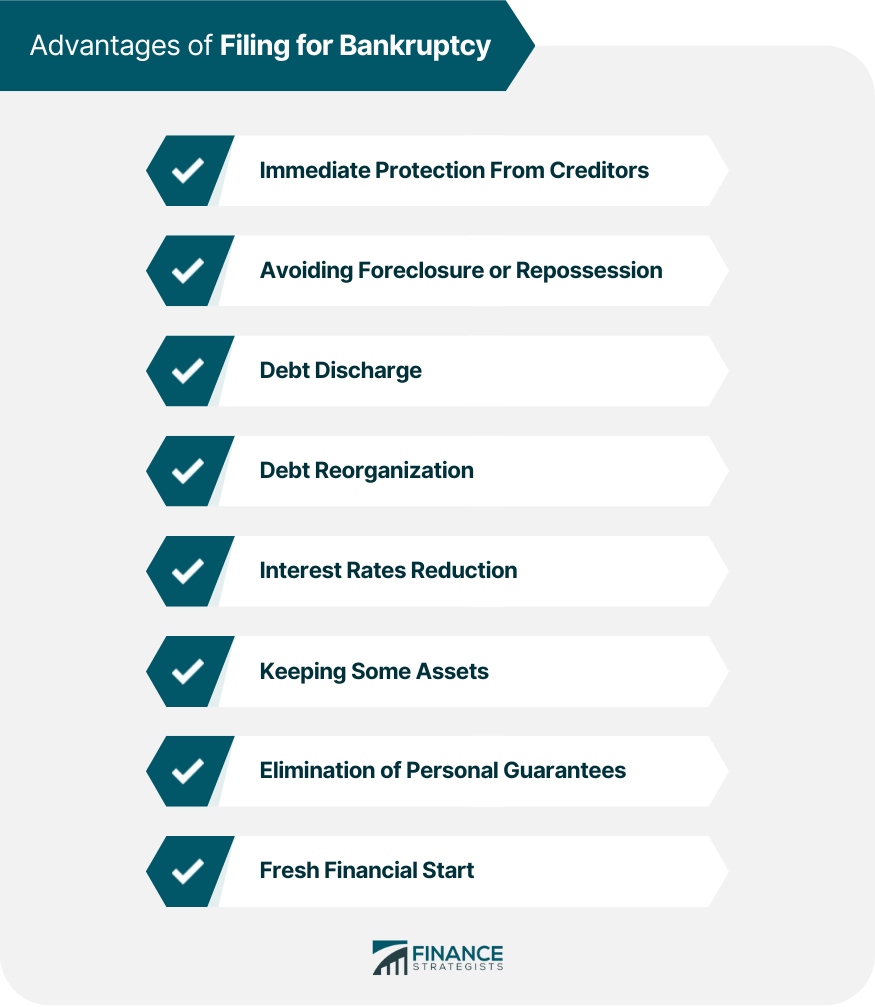

Reasons For Filing Bankruptcy

Reasons Why People Go Bankrupt · Termination of a Marriage · Medical Problems · Mismanagement of Finances · Unexpected Job Loss. Over-spending and excessive use of credit is the number one cause of bankruptcy. In truth, having more debt than you can handle may have started out by over-. It might be time to declare bankruptcy, if, for example, you have large debts that you can't repay, are behind in your mortgage payments and are in danger of. Health Care Costs Number One Cause of Bankruptcy for American Families The cost of health care is a major concern for nearly all Americans and there is no. If the bankruptcy filing will be under Chapter 7 (liquidation or “straight bankruptcy”), Chapter 11 (reorganization), Chapter 12 (adjustment of debts of a. A job loss is also a major reason for bankruptcy. Also some debt is not consumer debt, it can be business debt. Sometimes you go into business and things don't. The 3 Most Common Reasons Why People File Bankruptcy · 1. Job Loss · 2. Medical Problem · 3. Divorce. Divorce and separation are very expensive, and when. Bankruptcy is not merely a last resort; it's a strategic legal tool that can empower you to stop adverse actions, restructure your debts, and eliminate. What Are the Main Causes of Bankruptcy? · Creditors are suing for debt payment. · Your home is in danger of foreclosure. · The only way to pay for necessities is. Reasons Why People Go Bankrupt · Termination of a Marriage · Medical Problems · Mismanagement of Finances · Unexpected Job Loss. Over-spending and excessive use of credit is the number one cause of bankruptcy. In truth, having more debt than you can handle may have started out by over-. It might be time to declare bankruptcy, if, for example, you have large debts that you can't repay, are behind in your mortgage payments and are in danger of. Health Care Costs Number One Cause of Bankruptcy for American Families The cost of health care is a major concern for nearly all Americans and there is no. If the bankruptcy filing will be under Chapter 7 (liquidation or “straight bankruptcy”), Chapter 11 (reorganization), Chapter 12 (adjustment of debts of a. A job loss is also a major reason for bankruptcy. Also some debt is not consumer debt, it can be business debt. Sometimes you go into business and things don't. The 3 Most Common Reasons Why People File Bankruptcy · 1. Job Loss · 2. Medical Problem · 3. Divorce. Divorce and separation are very expensive, and when. Bankruptcy is not merely a last resort; it's a strategic legal tool that can empower you to stop adverse actions, restructure your debts, and eliminate. What Are the Main Causes of Bankruptcy? · Creditors are suing for debt payment. · Your home is in danger of foreclosure. · The only way to pay for necessities is.

While filing bankruptcy affects your credit and future ability to use money, people often effectively use it to prevent or delay foreclosure on a home and. Although these are the top five reasons many people file for bankruptcy, they are not the only reasons why it may be best to file bankruptcy. Your credit score will likely drop after filing for bankruptcy because it shows up on your credit report as a negative mark that can stay there for years after. Census Bureau Median Family Income By Family Size (Cases Filed On and After March 15, ) Claim for Exemption from Docket Management Program by Reason of. Filing bankruptcy can help a person by discarding debt or making a plan to repay debts. A bankruptcy case normally begins when the debtor files a petition with. The debtor failed to attend credit counseling · Their income, expenses, and debt would allow for a Chapter 13 filing · The debtor attempted to defraud creditors. Retaining a bankruptcy attorney could cost you several thousand dollars. If you prepare and file your own bankruptcy case, the filing fees alone are substantial. According to statistics, approximately million people file for bankruptcy every year, and 97% of those filings are individuals. Benefits of Bankruptcy · Prevent Repossession, Foreclosure, and Utility Shutoffs · Clear Your Debt · Stop Wage Garnishment and Other Aggressive Collection Efforts. Common causes of bankruptcy filing: job loss, medical emergency, lawsuit, credit card debt out of control, real estate crisis. Top 10 Reasons People File for Bankruptcy · 1. Medical Bankruptcies · 2. Unemployment · 3. Loss of a Family Member · 4. Lawsuit Judgment · 5. Divorce or Child. reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor's property should consult an attorney for advice. Commencement of a. If you have already filed bankruptcy What Is a Bankruptcy Discharge and How Does It Operate? One of the reasons people file bankruptcy is to get a “discharge. There are many reasons that you would consider filing for bankruptcy but the mot common reason include medical expenses, job loss or income reduction. According to our trustworthy attorney, Ted Alatsas, the top 5 causes for filing bankruptcy include divorce, medical expenses, loss of a job, credit cards. Many people prefer filing Chapter 7 bankruptcy instead of Chapter Chapter 7 has many advantages, such as discharging most medical bills, personal loans. Top 5 Reasons to File for Bankruptcy · You're Exhausted from Being Harassed by Creditors · You're in Danger of Losing Your Home · Your Business is in Financial. While there are many reasons to file for bankruptcy protection, there are a number of reasons for a person to not file for bankruptcy. Medical expenses – Medical bills are responsible for approximately 62 percent of all bankruptcy filings. · Layoffs · Reduced income · Credit card debt · Divorce. What are Common Reasons People File for Bankruptcy? · Financial Mismanagement · Credit Problems · Medical Costs · Separation or Divorce · Loss of Employment.

10k Real Estate

View homes for sale in Marathon, FL at a median listing home price of $ See pricing and listing details of Marathon real estate for sale. Simon is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations. I'm brand new, have spent hours and hours researching real estate investment. I'm a mother of 3 boys and I have $10k to my name. How can I get started? Apollo Commercial Real Estate Finance, Inc. is a real estate investment trust that primarily originates and invests in senior mortgages, mezzanine loans. Brandywine Realty Trust (NYSE: BDN) is one of the largest, publicly traded, full-service, integrated real estate companies in the United States. ☒ ANNUAL REPORT PURSUANT TO Account's investments in real estate properties, real estate joint ventures, real estate funds, a real estate operating. The best real estate investment options are house hacking, syndications, crowdfunding, rental properties, BRRRR method, and REITs. Maximize employer (k). We are a leader in integrated residential real estate services, combining the world's most extensive agent network, industry-leading brands, integrated. A real estate investment group offers management services for owners of single residential units. Buying a property outright to lease and manage demands a. View homes for sale in Marathon, FL at a median listing home price of $ See pricing and listing details of Marathon real estate for sale. Simon is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations. I'm brand new, have spent hours and hours researching real estate investment. I'm a mother of 3 boys and I have $10k to my name. How can I get started? Apollo Commercial Real Estate Finance, Inc. is a real estate investment trust that primarily originates and invests in senior mortgages, mezzanine loans. Brandywine Realty Trust (NYSE: BDN) is one of the largest, publicly traded, full-service, integrated real estate companies in the United States. ☒ ANNUAL REPORT PURSUANT TO Account's investments in real estate properties, real estate joint ventures, real estate funds, a real estate operating. The best real estate investment options are house hacking, syndications, crowdfunding, rental properties, BRRRR method, and REITs. Maximize employer (k). We are a leader in integrated residential real estate services, combining the world's most extensive agent network, industry-leading brands, integrated. A real estate investment group offers management services for owners of single residential units. Buying a property outright to lease and manage demands a.

BREIT gives individuals the ability to invest with the world's largest commercial real estate owner through a perpetually offered, non-listed REIT. Alpine Income Property Trust, Inc. (NYSE: PINE) is a publicly traded real estate investment trust that seeks to deliver attractive risk-adjusted returns and. Annual Report on Form K filed with the Securities and Exchange Commission Total asset value is calculated as fair value of investments in real estate. This list of companies and startups in the real estate investment space provides data on their funding history, investment activities, and acquisition trends. I would like to hear from anyone whose made about 10k or more a month continuously in real estate. How are you doing it? What did you do before real estate? A leader of integrated residential real estate services in the U.S. Anywhere Real Estate Inc. MOST RECENT Annual Report and Form 10K. View. The primary investment strategy is to acquire stabilized, income-generating real properties. The strategy also allows for equity investments in real estate. ANNUAL REPORTS. For a full account of Alexandria's activities and financial performance in the last year, read the full annual report. DOWNLOAD ARCHIVE. Focused on directly originating and managing a diversified portfolio of commercial real estate debt-related investments. 10K REALTY AND PROPERTY MANAGEMENT, Baltimore St, Blaine Mn, MN , 20 Photos, Mon - am - pm, Tue - am - pm. Marathon is a leading global asset manager specializing in the public and private credit markets with an unwavering focus on risk-management and exceptional. Zillow has homes for sale in Marathon FL. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. 10K Realty and Property Management, Anoka, Minnesota. likes · 2 talking about this · 2 were here. At 10K Realty and Property Management, we are a. Investor Relations · Press Releases · Annual Report and Proxy · SEC Filings · Presentations. AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate. $10ka month in real estate with no money down, no credit check, and no real estate license? Sounds too good to be true right!? But it's not! It's called. We are a global leader in real estate investing. We utilize our expertise to manage properties responsibly and generate returns for investors. Based in Uniondale, NY, ACRES Commercial Realty Corp. (NYSE: ACR) is a real estate investment trust that is primarily focused on originating, holding and. In India, real estate has always been a haven for investors due to its stable growth and high returns. But most people believe that investing in. A leader of integrated residential real estate services in the U.S. Anywhere Real Estate Inc. MOST RECENT Annual Report and Form 10K. View.

State Farm Jewelry Insurance Appraisal

It may include items such as furniture, appliances, electronics, clothing, jewelry, artwork, and other contents. Get Insurance ID Card · Business to. Over insurance agencies, including State Farm, Nationwide, Allstate, Erie Insurance, and independent insurance agencies, refer their clients to Vincent Lash. Our sample personal property appraisal will help determine your personal property value as well as replacement values. With more than 13 years of experience in the retail jewelry trade Dustin has worked with insurance companies such as State Farm, Allstate, Farmers, Chubb, Pure. Appraisals are good for a insurance replacement and to document originality. It is a good starting point for what it may be worth but that does not mean it. There are many insurance companies out there, including Geico, Progressive, State Farm, and Mutual, but none of them specialize in jewelry. Your homeowner's or. Our program bases the compensation to you, the jeweler, at a percentage over our cost of an item listed on the Jewelry Replacement Quotation Form. Please read your policy carefully, especially. “Losses Not Insured” and all exclusions. Page 2. ©, Copyright, State Farm Mutual Automobile Insurance Company. But remember, you have insurance to help with the repair or replacement when covered losses occur. Policy benefits may include: Payment for covered roof damage. It may include items such as furniture, appliances, electronics, clothing, jewelry, artwork, and other contents. Get Insurance ID Card · Business to. Over insurance agencies, including State Farm, Nationwide, Allstate, Erie Insurance, and independent insurance agencies, refer their clients to Vincent Lash. Our sample personal property appraisal will help determine your personal property value as well as replacement values. With more than 13 years of experience in the retail jewelry trade Dustin has worked with insurance companies such as State Farm, Allstate, Farmers, Chubb, Pure. Appraisals are good for a insurance replacement and to document originality. It is a good starting point for what it may be worth but that does not mean it. There are many insurance companies out there, including Geico, Progressive, State Farm, and Mutual, but none of them specialize in jewelry. Your homeowner's or. Our program bases the compensation to you, the jeweler, at a percentage over our cost of an item listed on the Jewelry Replacement Quotation Form. Please read your policy carefully, especially. “Losses Not Insured” and all exclusions. Page 2. ©, Copyright, State Farm Mutual Automobile Insurance Company. But remember, you have insurance to help with the repair or replacement when covered losses occur. Policy benefits may include: Payment for covered roof damage.

Georgetown Jewelers can also handle your insurance replacement needs. Our expertise in insurance matters has led us to be affiliated with State Farm Insurance. Too scared to leave your jewelry with someone you don't know for days or weeks while it gets appraised? We have an option for you! On September 4th, we will. Top 10 Best Jewelry Insurance in Los Angeles, CA - August - Yelp - Gemsecure Jewelry Appraisals, J.R.'S Diamonds & Jewelry, Ace of Diamonds. jewelry trade. Over insurance agencies, including State Farm, Nationwide, Allstate, Erie Insurance, and independent insurance agencies, refer their. Orin Jewelers specializes in Jewelry Insurance Replacement Appraisals, Estate Appraisals, and Gemstone Identification. The DeVolders insured the ring and their other jewelry through State Farm in a personal articles policy with inflation coverage. Premiums were based on the. our insurance is through State Farm so I just went with them, I got a personal article policy. Go see your insurance agent ASAP and take your appraisal with you. Most insurance companies require a formal appraisal to properly insure a piece of jewelry. State Farm • AAA • Farmers • And many others. The Orin Legacy. Valuables such as jewelry may be covered up to a limit, but that may not reflect the full value of the item. As an agent, I recommend getting appraisals for all. For scheduled jewelry, regardless of where you are in the world, it the item is lost or stolen, the insurance company will pay up to the appraised amount for. Yes, State Farm homeowners insurance typically covers jewelry for theft. However, coverage limits and conditions may apply, so it's important to review your. Consider getting an appraisal, which is a detailed description of your ring and its value provided by a certified appraiser. While all insurers don't require. To obtain jewelry insurance, your item(s) must be appraised and the appraisal be submitted to the insurance company. Raleigh Diamond is happy to offer our. The most common reason an appraisal report is needed is for insurance purposes. It doesn't matter if you have $5,, $20,, $, or more in jewelry you. Insurance companies will require an official appraisal document from a reputable jeweler. Every 4 years, you should provide an updated appraisal to your. It may include items such as furniture, appliances, electronics, clothing, jewelry, artwork, and other contents. Get Insurance ID Card · Business to. Both the appraisal and the jewelry insurance If you do choose to go this route, I recommend State Farm, because we've had good experiences with them. Her insurer wanted their out-of-state jewelry store to provide a comparable value ring. Most insurance companies require appraisals, especially for more. jewelry claims for large primary insurance companies such as State Farm, Allstate, Chubb, and Farmers. That in-store experience has given me. Your typical property and casualty insurance company, State Farm will cover your fine jewelry — usually as an additional floater or "personal articles policy".

Best Personal Loan To Pay Off Debt

Some of the best include SoFi, LightStream, and Payoff for their good interest rates and flexible terms. However, it's crucial to compare rates. An unsecured personal loan can help you make home repairs, cover medical expenses, pay down debt, and more. Plus, it could lower your monthly payment and save. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Discover personal loan is an excellent choice for debt consolidation (as long as you aren't using it to pay off your loan balance on a Discover credit. Fixed low payment; Terms up to 84 months; No origination or account fees; Loans for up to $50,; Transfer cash into your account; Competitive rates. One of the fastest ways to lower or consolidate debt is to get a loan. A loan that is large enough to allow you to pay off all your creditors (also known as a. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Pros · Cons · Upstart: Best for borrowers with bad credit. A personal loan to pay off credit cards With a simple interface and quick application process, The Payoff Loan™ streamlines paying off credit card debt. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. Some of the best include SoFi, LightStream, and Payoff for their good interest rates and flexible terms. However, it's crucial to compare rates. An unsecured personal loan can help you make home repairs, cover medical expenses, pay down debt, and more. Plus, it could lower your monthly payment and save. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Discover personal loan is an excellent choice for debt consolidation (as long as you aren't using it to pay off your loan balance on a Discover credit. Fixed low payment; Terms up to 84 months; No origination or account fees; Loans for up to $50,; Transfer cash into your account; Competitive rates. One of the fastest ways to lower or consolidate debt is to get a loan. A loan that is large enough to allow you to pay off all your creditors (also known as a. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Pros · Cons · Upstart: Best for borrowers with bad credit. A personal loan to pay off credit cards With a simple interface and quick application process, The Payoff Loan™ streamlines paying off credit card debt. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub.

Personal loan that dramatically reduces the amount of interest is a good idea overall. Whether that be a balance transfer or an unsecured loan. Get rid of your debt faster (and spend less money) by using a loan to pay off high interest debts, like credit cards. Let's see which one's best for you. debt at a competitive, fixed rate. Features: Affordable monthly payments; $ to $50, loan amounts. Tiered Rates for the Debt Consolidation Loan. Terms, APR. All personal loans have a % to % origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of. A debt consolidation loan may help you pay off higher-interest debt by combining multiple balances into one payment. Get up to $ with Discover. Competitive Loan Terms Loan amounts up to $30, with affordable monthly payments and fixed for life rates from % APR to % APR2, no collateral. Personal Loans for Debt Consolidation A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired. One way to consolidate multiple debts is to use a personal loan. When you apply for a personal loan, you apply for a lump sum of money that typically gets. Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing that. While personal loans can be used for a variety of reasons when you need extra cash, such as funding a vacation or buying a new couch, if you need to consolidate. CNBC Select ranked LightStream as the best personal loan lender overall because of its low interest rates and flexible terms, but PenFed is also good for those. It begs the question -- why do these companies offer loans that are advertised as CC debt consolidation loans, and yet my applications are. Hear from our editors: 4 best debt consolidation loans of · Best for multiple repayment terms: Discover · Best for credit card debt consolidation: Payoff. Right for you if you: · Prefer to borrow a specific amount with structured payments and a fixed interest rate to pay off your debt within a set time period · Want. Choose a personal loan for lump sum expenses like travel, renovations, or debt consolidation. Unlike a line of credit, you'll receive your funds all at once. Debt Consolidation Loan Lenders ; NASA Federal Credit Union, Repayment terms, $1, to $30,, 0 to 84 months, % to % ; Citibank, Big bank, $2, to. Features and Benefits · Rates are fixed, so your payment doesn't change. · Interest rates as low as % APR. · Up to $30, in one lump sum. · Funds are. Get personalized rates in 60 seconds for personal loans to pay off debt with no impact to your credit score. We offer a large Debt Consolidation Loan with low interest to pay off small debts, such as credit cards or student loans and other numerous debts. Personal Loan. Ideal for when you want a structured repayment plan that pays off your loan balance by the end of a specified period of time.

Mutual Funds For Conservative Investors

The investment objectives of the Conservative Allocation Fund are long-term capital appreciation, capital preservation and current income. Strategy and Process. Who should buy this fund? · You want a simple, all-in-one investment solution that saves you valuable time · a portfolio that targets a potential maximum return. The Conservative Growth Fund seeks to provide current income and low to moderate capital appreciation. The fund holds 60% of its assets in bonds, a portion of. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. For the cautious investor, get the highest percentage of fixed-income securities—plus a small exposure to equity to help protect your nest egg from rising. Are you looking for a lower-priced, hands-off investment fund that complements your overall portfolio? Growth Index Funds may be the right solution for you. Conservative. Conservative asset allocation mutual funds hold more in fixed income securities than equities. These funds may also invest in dividend-paying. The Lifestyle Conservative Fund seeks long-term total return, consisting of current income and capital appreciation. The Fund will pursue this goal through. Objective. The investment objective of the Conservative Portfolio is preservation of capital by allocating its assets among bond and money market mutual funds. The investment objectives of the Conservative Allocation Fund are long-term capital appreciation, capital preservation and current income. Strategy and Process. Who should buy this fund? · You want a simple, all-in-one investment solution that saves you valuable time · a portfolio that targets a potential maximum return. The Conservative Growth Fund seeks to provide current income and low to moderate capital appreciation. The fund holds 60% of its assets in bonds, a portion of. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. For the cautious investor, get the highest percentage of fixed-income securities—plus a small exposure to equity to help protect your nest egg from rising. Are you looking for a lower-priced, hands-off investment fund that complements your overall portfolio? Growth Index Funds may be the right solution for you. Conservative. Conservative asset allocation mutual funds hold more in fixed income securities than equities. These funds may also invest in dividend-paying. The Lifestyle Conservative Fund seeks long-term total return, consisting of current income and capital appreciation. The Fund will pursue this goal through. Objective. The investment objective of the Conservative Portfolio is preservation of capital by allocating its assets among bond and money market mutual funds.

Diverse mix of quality underlying mutual funds and exchange-traded funds managed by Manulife. Investment Management and experienced sub-advisors Mawer. This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and. Mutual funds are a simple, affordable way to diversify your portfolio and benefit from professional investment management. This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and. The Nuveen Lifestyle Conservative Fund seeks long-term total return through both current income and capital appreciation using a “fund of funds” approach. Mutual funds sponsored by Mackenzie Investments are only qualified for sale in the provinces and territories of Canada. Please read a fund's prospectus and. The Portfolio seeks to achieve a combination of income and some long-term capital growth by investing primarily in a diverse mix of fixed income and equity. The Conservative ETF Portfolio is a balanced Please read the CIBC Mutual Funds and CIBC Family of Portfolios simplified prospectus before investing. 25 Tips Every Mutual Fund Investor Should Know 7 Questions to Ask When Buying a Mutual Fund Complete Guide to Mutual Fund Expenses A Brief History of Mutual. Mode of investment: There are two routes available for investing in the best conservative mutual funds – Systematic Investment Plan (SIP) and lump sum. SIP. View performance for the Thrivent Moderately Conservative Allocation Fund, which pursues long-term growth by investing mostly in bonds and some in stocks. The PGIM Conservative Retirement Spending Fund may be appropriate for investors who are near or in retirement who are looking to address essential spending in. Is this fund right for you? · Conservative investors who are looking to generate a moderate level of income with the potential for some long-term capital growth. As such, a conservative investment portfolio will have a larger proportion of low-risk, fixed-income investments and a smaller smattering of high-quality stocks. To achieve maximum total return, consistent with preservation of capital and prudent investment management. Primary Portfolio. Primarily mutual funds managed by. Conservative mutual funds are balanced funds that provide higher returns with lower risk. The percentage of debt securities in these funds ranges between Compare all mutual funds in conservative hybrid fund,conservative hybrid category based on multiple parameters like Latest Returns, Annualised Returns. ICICI Prudential Commodities Fund|; Nippon India Small Cap Fund|; Parag Parikh Flexi Cap Fund|; Groww Nifty Total Market Index Fund|; SBI Small Midcap Fund|. investment funds with some exposure to equity investment funds View fund prospectus. Prospectus. Scotia Mutual Funds Prospectus N/A | pdf. Total Net Assets, $M ; Minimum Investment, $ ; Expense Ratio · % ; Adjusted Expense Ratio, % ; CUSIP,

With Renewable Term Insurance

policy's start, and the premium remains the same (level) for the length of the term. So, premiums for 5-year renewable term can be level for 5 years, then. A convertible policy gives the owner the option to change a term life insurance policy into a whole life policy without a medical exam or underwriting. A. Renewable Term Life Insurance provides a simple and convenient way for customers to extend or maintain their existing life insurance coverage. Renewable Term. A renewable term life policy allows you to reassess your needs for insurance coverage each year. Cost-Efficient. Because you are only renewing your old policy. Renewable and convertible (R&C) term life insurance refers to a form of term life insurance that is usually issued for a period of 1 or 5 years that can be. Affordable Term Life Insurance from Woman's Life Insurance Society offers level premium and fixed death benefit for 10 years, renewable and convertible with. Generally, 6x – 10x more expensive than term for the same death benefit; but as cash value builds it can be used to supplement premiums. Cost over time. Renewal. Renewable term life insurance is a type of term life insurance that is designed to be renewed on a regular basis. As a rule, term policies offer a death benefit with no savings element or cash value. Premiums are locked in for the specified period of time under the policy. policy's start, and the premium remains the same (level) for the length of the term. So, premiums for 5-year renewable term can be level for 5 years, then. A convertible policy gives the owner the option to change a term life insurance policy into a whole life policy without a medical exam or underwriting. A. Renewable Term Life Insurance provides a simple and convenient way for customers to extend or maintain their existing life insurance coverage. Renewable Term. A renewable term life policy allows you to reassess your needs for insurance coverage each year. Cost-Efficient. Because you are only renewing your old policy. Renewable and convertible (R&C) term life insurance refers to a form of term life insurance that is usually issued for a period of 1 or 5 years that can be. Affordable Term Life Insurance from Woman's Life Insurance Society offers level premium and fixed death benefit for 10 years, renewable and convertible with. Generally, 6x – 10x more expensive than term for the same death benefit; but as cash value builds it can be used to supplement premiums. Cost over time. Renewal. Renewable term life insurance is a type of term life insurance that is designed to be renewed on a regular basis. As a rule, term policies offer a death benefit with no savings element or cash value. Premiums are locked in for the specified period of time under the policy.

Renewable term life insurance is frequently confused with convertible term life insurance. A renewable term life insurance policy allows you to simply extend. The benefit of a renewable term life insurance policy allows you to extend the term of the insurance at end of the term. Usually, it is in one-year. RIDER. YEARLY RENEWABLE DECREASING TERM BENEFIT PROVISION WITH PROVISION FOR CHANGE OF PREMIUMS. ADDITIONAL INSURANCE FOR A TERM PERIOD AND PAYABLE IF THE. RENEWABLE TERM INSURANCE definition: Renewable term insurance is term life insurance that may be renewed for another period | Meaning, pronunciation. If a policy is “renewable,” that means it continues in force for an additional term or terms, up to a specified age, even if the health of the insured (or other. Universal life insurance is a flexible adjustable life policy, which incorporates annually renewable term insurance with an interest bearing side fund (cash. Renewable term insurance is a type of life insurance policy that offers coverage for a specific period, allowing the policyholder to renew the policy at the. A renewable term is a clause in a term insurance policy that allows the beneficiary to extend the coverage term for a set period of time without having to re-. However, after the level premium period expires, most policies become annually renewable. Therefore, in the same way as described above, premium rates will. Yearly renewable term life insurance is only cost effective for a few years because of the rising premiums. If you need term insurance protection for more than. Annual Renewable Term insurance is term life insurance with a guarantee of future insurability for a set period of years on a renewable basis. The death benefit they receive is almost always paid out income tax-free – unless the premiums are paid with pre-tax dollars. As we've noted, these policies. insurance will increase each year. What is “renewable” term life insurance? +. Many term life insurance policies are described as being “renewable”. This. The benefit of a renewable term life insurance policy allows you to extend the term of the insurance at end of the term. Usually, it is in one-year. This article will break down everything you need to know about annually renewable term insurance coverage. We'll cover how it works, the benefits and drawbacks. Yearly renewable term may be the right choice if you want protection for a particularly short period or think your needs could change soon. Premiums generally. You will receive your life insurance certificate of coverage, along with your first bill in approximately weeks following approval. Apply today for Term. There are two kinds. There's "annual renewable term," which gives you one year of coverage at a time that you renew annually, and "level premium term," which. A renewable term insurance policy allows you to renew your plan regularly without a requalification process. Most term policies come with an annual renewable. Discover the features and options of Renewable Term Life Insurance policies. Learn how these policies provide temporary coverage with the flexibility to.

Best Cc

Is the Capital One Venture Rewards Credit Card Right For You? Click to learn more and apply today. Annual Fee: $95 Regular APR: % – % (Variable) Terms. Best for cash back: Chase Freedom Unlimited® · Best for travel rewards: Chase Sapphire Preferred® Card · Best for hotels: Marriott Bonvoy Boundless® Credit Card. NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of – from generous rewards and giant sign-up bonuses. You're #1 with us. Ranked #1 for Best Community Colleges in New York. Apply to KCC. Credit cards with 0% intro APR offers help you save interest and pay off debt faster. The best credit card for you depends on how you use credit. There's no one. Marriott Bonvoy Bountiful ™ credit card. Marriott Bonvoy Bold(Registered Trademark) credit card. OUR BEST OFFER EVER! Marriott Bonvoy Bold® Credit Card. Earn. Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred® Card: Best for beginner travelers · Ink Business Preferred®. Chase Sapphire Preferred® Card – this is the best overall card for folks who want to travel the world via credit card rewards. Shop our award-winning, best-selling full-coverage CC Cream in natural, radiant, matte, and healthy glow finishes that are perfect for all skin types. Is the Capital One Venture Rewards Credit Card Right For You? Click to learn more and apply today. Annual Fee: $95 Regular APR: % – % (Variable) Terms. Best for cash back: Chase Freedom Unlimited® · Best for travel rewards: Chase Sapphire Preferred® Card · Best for hotels: Marriott Bonvoy Boundless® Credit Card. NerdWallet's credit card experts have reviewed and rated hundreds of options for the best credit cards of – from generous rewards and giant sign-up bonuses. You're #1 with us. Ranked #1 for Best Community Colleges in New York. Apply to KCC. Credit cards with 0% intro APR offers help you save interest and pay off debt faster. The best credit card for you depends on how you use credit. There's no one. Marriott Bonvoy Bountiful ™ credit card. Marriott Bonvoy Bold(Registered Trademark) credit card. OUR BEST OFFER EVER! Marriott Bonvoy Bold® Credit Card. Earn. Capital One Venture Rewards Credit Card: Best for non-bonus spending · Chase Sapphire Preferred® Card: Best for beginner travelers · Ink Business Preferred®. Chase Sapphire Preferred® Card – this is the best overall card for folks who want to travel the world via credit card rewards. Shop our award-winning, best-selling full-coverage CC Cream in natural, radiant, matte, and healthy glow finishes that are perfect for all skin types.

Don't settle for any credit card. Find the right one. · Best Cards · 0% APR · Balance Transfer · Cash Back · Rewards · CardMatch™. Get points per $1 spent (5% back in rewards) on qualifying Best Buy® purchases when you choose Standard Credit with your Best Buy Credit Card. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. About the Block Plan · CC Life · CC Stories · Happening on Campus. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. Platinum Prestige Mastercard Secured Credit Card. Intro bonus: N/A*. Rewards: 1% (cash back). Discover the best CC Facial Creams in Best Sellers. Find the top most popular items in Amazon Beauty & Personal Care Best Sellers. CC's City Broiler. We Are More Than a Steakhouse. CC's City Broiler Is Columbia, MO's Favorite Restaurant for Seafood, Wine & Great Times. Our credit card comparison tool lets you compare each Discover credit card with credit cards from other issuers. Compare features to find the best card for. Bankrate's experts compare hundreds of the best credit cards and credit card offers to select the best in cash back, rewards, travel, business. Is the Capital One Venture Rewards Credit Card Right For You? Click to learn more and apply today. Annual Fee: $95 Regular APR: % – % (Variable) Terms. often makes sense to pay an annual fee for a credit card, and when it may not. Read our reviews. BankAmericard Review: A Great Breather From Credit Card. Frequent Miler, a top authority on rewards credit cards, actively maintains this list of best credit card offers. The secret to earning millions. Credit Card BenefitsExplore built-in card benefits. Find great deals with Capital One Shopping. Get free coupon. Compare All Credit Cards. Credit level. Manage your Best Buy credit card account online, any time, using any device. Submit an application for a Best Buy credit card now. With expert reviews and advice, U.S. News helps you find the best credit card 0% APR Airline Balance Transfer Business Cash Back Rewards Student. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. Find the best credit card for your lifestyle and choose from categories like rewards, cash back and no annual fee. Get the most value from your credit card. September 's best credit card rates are selected by WalletHub editors from + credit card offers. Get expert help choosing the best credit card rate.

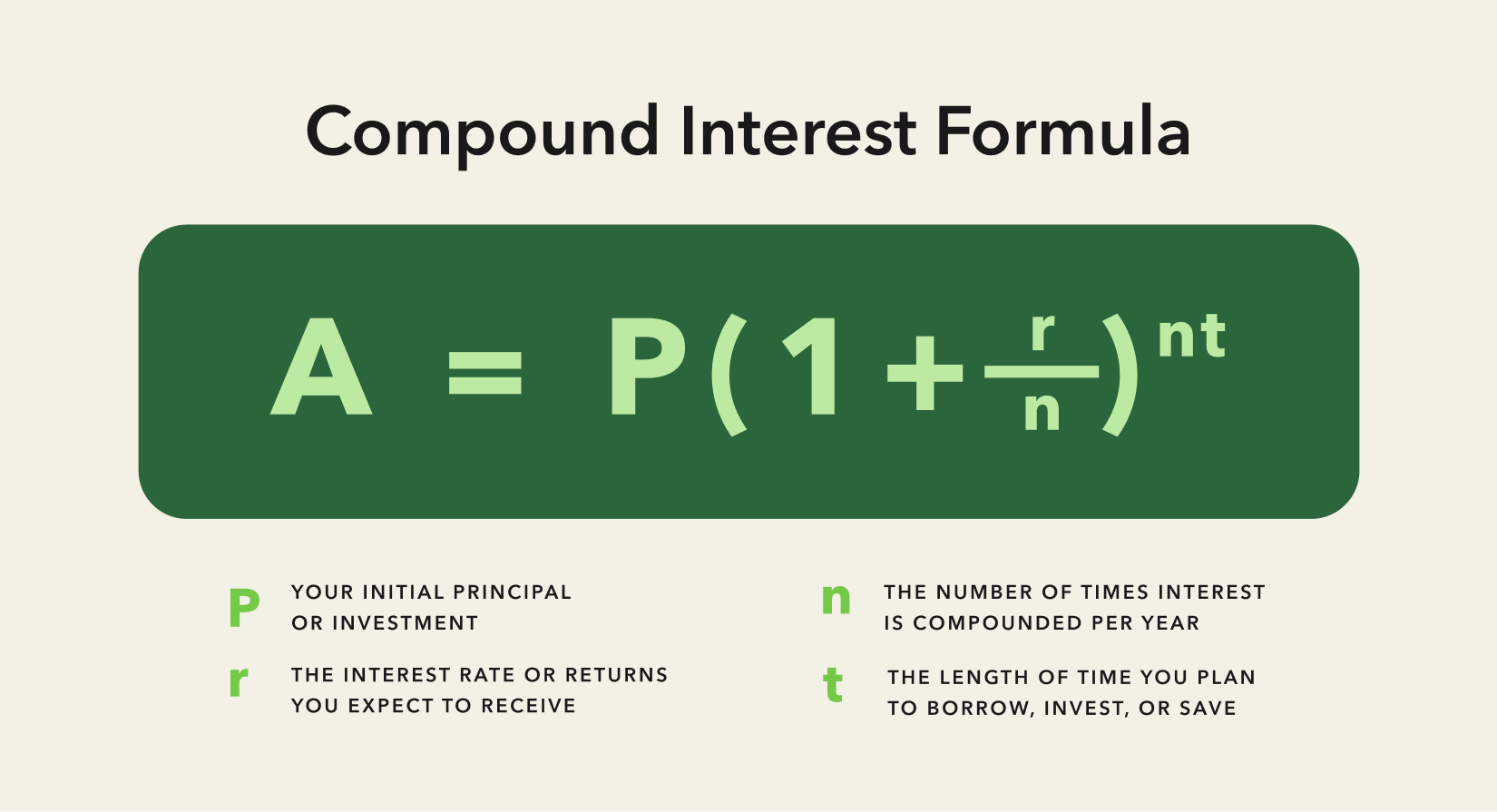

Interest Equation

The formula for calculating the future value of an interest earning account is \displaystyle FV = PV(1+\frac{r}{n})^{tn}, where. interest. The formula to calculate simple interest is: interest = principal × interest rate × term. When more complicated frequencies of applying interest. Simple Interest is calculated using the following formula: SI = P × R × T, where P = Principal, R = Rate of Interest, and T = Time period. Here, the rate is. The future value of money after n period with an interest rate of i can be calculated using the Equation F=P(1+i)n. Compound interest is taken from the initial – or principal – amount on a loan or a deposit, plus any interest that has already accrued. A simple job, with lots of calculations. But there are quicker ways, using some clever mathematics. Make A Formula. Let us make a formula for the above just. The compound interest formula is ((P*(1+i)^n) - P), where P is the principal, i is the annual interest rate, and n is the number of periods. Using the same. Simple interst. tell yourself "I party". I interest = P princial, R, rate, T time. Super easy and you won't forget it. Interest Formulas for simple and compound interests are provided here. Learn here, how to find the SI and CI using the formulas for interest along with. The formula for calculating the future value of an interest earning account is \displaystyle FV = PV(1+\frac{r}{n})^{tn}, where. interest. The formula to calculate simple interest is: interest = principal × interest rate × term. When more complicated frequencies of applying interest. Simple Interest is calculated using the following formula: SI = P × R × T, where P = Principal, R = Rate of Interest, and T = Time period. Here, the rate is. The future value of money after n period with an interest rate of i can be calculated using the Equation F=P(1+i)n. Compound interest is taken from the initial – or principal – amount on a loan or a deposit, plus any interest that has already accrued. A simple job, with lots of calculations. But there are quicker ways, using some clever mathematics. Make A Formula. Let us make a formula for the above just. The compound interest formula is ((P*(1+i)^n) - P), where P is the principal, i is the annual interest rate, and n is the number of periods. Using the same. Simple interst. tell yourself "I party". I interest = P princial, R, rate, T time. Super easy and you won't forget it. Interest Formulas for simple and compound interests are provided here. Learn here, how to find the SI and CI using the formulas for interest along with.

The compound interest formula can be used to find the amount of interest that has been earned over a period of time. The EFFECT function returns the compounded interest rate based on the annual interest rate and the number of compounding periods per year. The formula to. Compound interest calculations are based on the amounts in all your accounts, even as they change and grow. Explanation of Simple Interest Calculation. Interest on your loan accrues daily. It is for this reason that the portion of your monthly payment allocated to. In this formula: I = Total simple interest; P = Principal amount or the original balance; r = Annual interest rate; t = Loan term in years. There are two formulas that are used for compound interest: Discrete Compound Interest Formula. This is used for interest that is not compounded continuously. Simple interest formula, definition, and example. Simple interest is a calculation of interest that doesn't take into account the effect of compounding. Compound interest is more complex than simple interest. It lets you gain value on the principal and accumulated interest. A=P(1+r/n)^nt. If interest is compounded annually, the formula for the amount to be repaid is: A = P(1 + r)^t where r is the annual interest rate and t is the number of years. Compound Interest Formula. FV=PV(1+i)^N. Annuity Formula. FV=PMT(1+i)((1+i)^N - 1)/i. where PV = present value FV = future value PMT = payment per period i. Interest Formulas for simple and compound interests are provided here. Learn here, how to find the SI and CI using the formulas for interest along with. Simple interest is calculated by multiplying the principal, the amount of money that is initially invested or borrowed, by the rate, the speed at which the. Compound interest · 1 Compounding frequency · 2 Annual equivalent rate · 3 Examples · 4 History · 5 Calculation. Periodic compounding; Accumulation function. Use the formula, Interest = Principal x Rate x Time, and rearrange it algebraically to solve for the rate. Rate = Interest / (Principal x Time). Then, fill in. Compound interest is “interest-on-interest”, or the ability of a financial instrument to generate earnings on its earnings. See the compound interest. Compound Interest Formula · A = amount · P = principal · r = rate of interest · n = number of times interest is compounded per year · t = time (in years). The interest rate is understood to be annual with annual compounding. Examples: "12% interest" means that the interest rate is 12% per year, compounded. To calculate simple interest, the formula used is (P x r x t)/ where P, r, and t stands for principal amount, rate of interest and tenure of the deposit in. Interest Problems · x = amount invested at 6% · $12, = total money invested in both accounts · x + y = 12, · Interest = (Principle)(Rate)(Time) · Interest. I is the interest earned, P is the principal amount, r is the interest rate as a decimal, and n is the number of years remaining on the loan.